It’s inevitable that unexpected emergencies will arise at some point in our lives, and it’s crucial to have a plan in place to protect our finances from the financial strain that comes with these unforeseen events. In order to safeguard your financial stability, it’s important to consider a variety of proactive measures and strategies to ensure you’re prepared to handle any unexpected financial setbacks. From building an emergency fund to investing in insurance policies, there are several ways to protect your finances and secure your financial future. In this blog post, we will explore the best practices for preparing for unexpected emergencies and discuss the steps you can take to shield your finances from potential financial turmoil.

1. Build an emergency fund with 3-6 months of expenses.

2. Set up automatic contributions to your emergency savings account.

3. Invest in insurance for health, home, and car.

4. Create a budget and stick to it.

5. Diversify your investments for added protection.

6. Stay informed about your financial situation and adjust as needed.

Assessing Your Financial Risks

Some unexpected emergencies can have a significant impact on your finances. It’s crucial to assess your financial risks and prepare for the unexpected. One way to do this is by having an emergency fund in place. Check out this Emergency Fund: How To Make One & Alternatives guide for more information on this essential financial tool.

Understanding Potential Emergencies

Assessing the potential emergencies that could affect your finances is the first step in protecting your financial well-being. These could include medical emergencies, job loss, natural disasters, or unexpected home or car repairs. By understanding these potential emergencies, you can better prepare for them financially and mitigate their impact on your overall financial stability.

Evaluating Personal Risk Factors

Assessing your personal risk factors is crucial in determining how vulnerable you are to unexpected emergencies. Factors such as your employment stability, health status, and location can all play a role in your financial risk. To evaluate your personal risk factors, consider the following:

- Employment stability

- Health status

- Geographical location

This evaluation will help you understand which areas of your finances may be most vulnerable to unexpected emergencies and how to prioritize your financial protection efforts.

Factors such as employment stability, health status, and geographical location play a crucial role in determining your financial vulnerability to unexpected emergencies. By evaluating these personal risk factors, you can better prepare for potential financial challenges.

Building an Emergency Fund

One of the most important steps in protecting your finances from unexpected emergencies is to build an emergency fund. This is a dedicated savings account specifically for covering unexpected expenses, such as medical bills, car repairs, or sudden job loss. Building an emergency fund can provide financial security and peace of mind, knowing that you have a cushion to fall back on when the unexpected happens.

Determining How Much You Need

To determine how much you need in your emergency fund, it’s important to consider your monthly expenses, including bills, groceries, and other essential costs. Ideally, your emergency fund should cover at least three to six months’ worth of expenses. However, this amount can vary depending on your personal circumstances, such as whether you have dependents or a stable source of income. It’s important to take the time to carefully assess your financial situation to determine the appropriate amount for your emergency fund.

Strategies for Saving Effectively

Strategies for saving effectively for your emergency fund include setting a monthly savings goal and automating your savings by setting up automatic transfers from your checking account to your emergency fund. You can also consider cutting back on non-essential expenses and directing those savings towards your emergency fund. Additionally, consider creating a separate high-yield savings account specifically for your emergency fund, so that your money can grow over time.

A high-yield savings account can offer better interest rates than traditional savings accounts, helping your emergency fund to grow more quickly. Remember, the goal is to have a dedicated fund that you can rely on in times of need, and these strategies can help you achieve that.

Insurance and Protection Measures

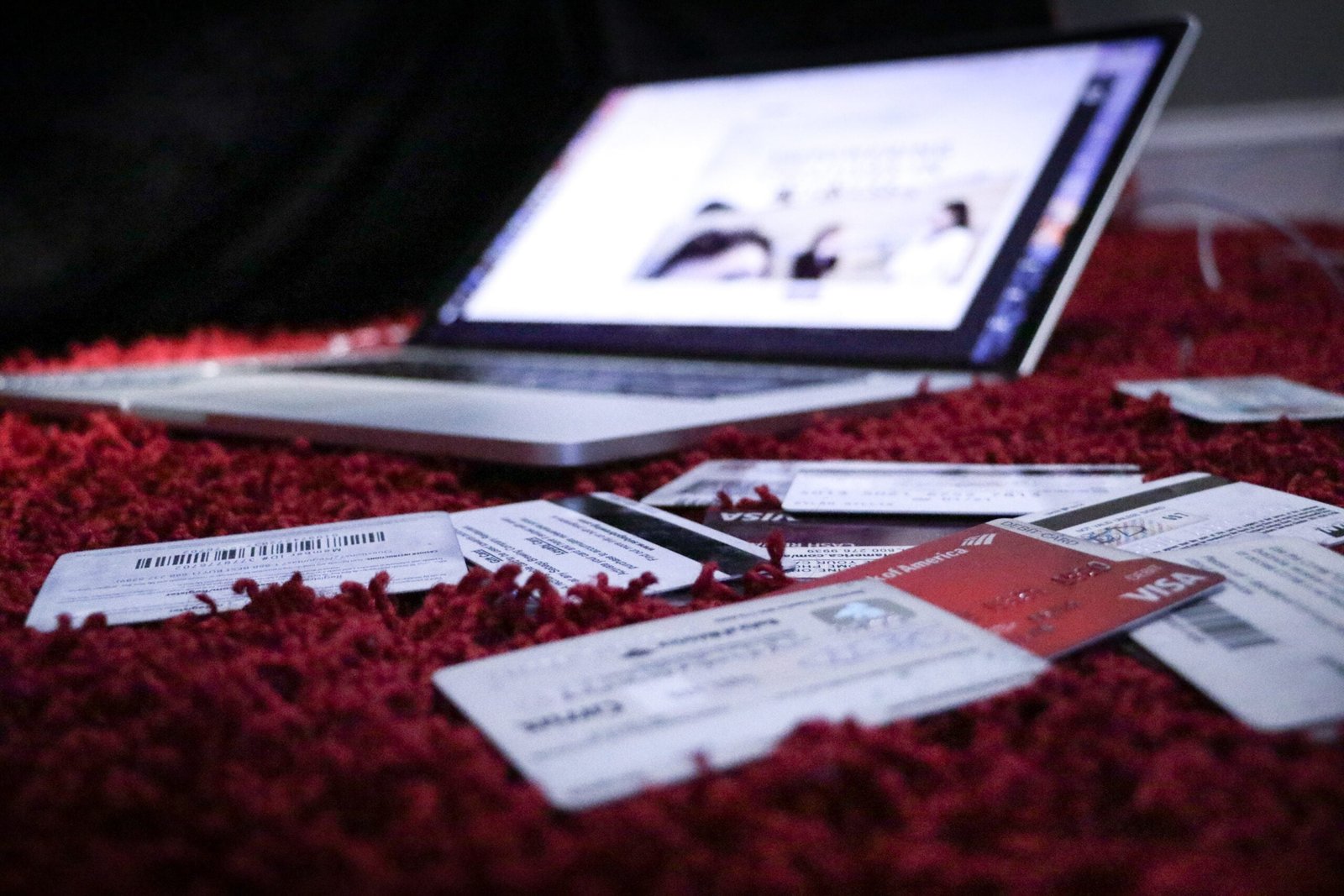

Not prepared for unexpected emergencies can have a significant impact on your finances. This is where insurance and other protective measures come into play to provide a safety net for you and your family. It’s crucial to understand the types of insurance available and other protective measures you can take to ensure financial security in times of need.

Types of Insurance for Financial Security

Insurance is a critical component of protecting your finances from unforeseen emergencies. There are various types of insurance to consider, including:

- Health insurance to cover medical expenses

- Life insurance to provide financial support for loved ones in the event of your passing

- Auto insurance to protect against vehicle-related accidents and damages

- Home insurance to safeguard your property from unexpected events

- Disability insurance to provide income if you are unable to work due to a disability

Any of these insurance policies can help alleviate the financial burden of unforeseen emergencies, providing peace of mind and stability for your finances.

Other Protective Measures to Consider

One additional protective measure to consider is an emergency fund. By setting aside a portion of your income in a dedicated savings account, you can be better prepared for unexpected expenses. Additionally, creating a will and establishing a power of attorney are important steps to ensure your assets are protected and your wishes are carried out in the event of incapacitation or passing.

For instance, having an emergency fund can help cover sudden medical expenses or home repairs, while a will and power of attorney can provide clear instructions for the distribution of your assets and decision-making authority in case of emergencies.

Practical Tips for Financial Resilience

Now, when it comes to protecting your finances from unexpected emergencies, it’s important to take proactive steps to build financial resilience. Here are some practical tips to help you strengthen your financial security:

- Diversify your income streams

- Create a financial contingency plan

- Build an emergency fund

- Invest in insurance

Though unexpected emergencies can be difficult to predict, implementing these strategies can help ensure that you are prepared to handle any financial challenges that come your way.

Diversifying Your Income Streams

Diversifying your income streams is a key strategy for building financial resilience. By relying on multiple sources of income, you can minimize the impact of a sudden loss of income from one source. This could involve taking on a side hustle, investing in stocks or real estate, or starting a small business. The key is to have a diverse range of income streams that can provide stability and security, even in times of uncertainty.

Creating a Financial Contingency Plan

An essential aspect of protecting your finances from unexpected emergencies is creating a financial contingency plan. This involves setting aside a specific amount of money for emergencies, establishing a budget, and prioritizing essential expenses. It also involves having a plan in place for how you will manage your finances in the event of a financial crisis, such as job loss or a medical emergency. By taking these proactive steps, you can ensure that you are financially prepared for any unexpected challenges that may arise.

Streams. By diversifying your income and establishing a financial contingency plan, you can strengthen your financial resilience and protect yourself from unexpected emergencies. It’s important to take proactive steps now to safeguard your financial future.

Conclusively Protecting Your Finances From Unexpected Emergencies

In conclusion, it is crucial to have a solid financial plan in place to protect your finances from unexpected emergencies. This includes maintaining an emergency fund, having adequate insurance coverage, and creating a budget to manage expenses. Taking proactive steps such as establishing a savings habit and regularly reviewing your financial situation will help you weather unexpected financial challenges. By following these strategies, you can build a protective shield around your finances and have peace of mind knowing that you are prepared for any unforeseen circumstances.